Understanding Bad Debt and Economic Downturns

Bad debt is a financial obligation that carries a high level of risk for the borrower, often leading to financial instability. Unlike good debt, which can be an investment in one’s future—such as a mortgage or student loan—bad debt typically accrues from high-interest loans, credit card debt, and predatory lending practices. These forms of debt do not contribute to the growth of personal wealth and can, in many cases, lead to a downward financial spiral.

High-interest loans are a significant contributor to bad debt. These loans often come with exorbitant interest rates that make repayment difficult, causing the borrower to pay significantly more than the initial loan amount. Credit card debt is another common form of bad debt. While credit cards can be useful for managing short-term expenses, their high-interest rates can quickly turn manageable balances into overwhelming financial burdens.

Predatory lending practices compound these issues by targeting vulnerable consumers with unfair, deceptive, or abusive loan terms. These practices often prey on individuals who are already experiencing financial difficulties, making it nearly impossible for them to escape the cycle of debt.

Economic downturns exacerbate the challenges associated with bad debt. During periods of economic instability, job losses, reduced income, and increased living costs can significantly impact consumers’ financial health. For example, during the 2008 financial crisis, the U.S. unemployment rate surged to 10%, leaving millions of Americans without a steady income. This loss of income, combined with rising living costs, made it increasingly difficult for individuals to manage and repay their debts.

Real-life examples underscore the severity of these issues. According to a 2021 study by the Federal Reserve, more than 25% of American adults reported that they had difficulty paying bills or were unable to pay them in full due to economic conditions. Moreover, the Consumer Financial Protection Bureau found that during economic downturns, defaults on high-interest loans and credit card debt spike, further highlighting the perilous nature of bad debt.

Understanding the dynamics of bad debt and the impact of economic downturns is crucial for navigating financial challenges. By recognizing the risks and consequences associated with bad debt, consumers can make more informed financial decisions and seek appropriate solutions, such as Chapter 7 bankruptcy, to mitigate the adverse effects of economic instability.

The 7 Sins of Bad Debt

During economic downturns, the financial health of consumers can be greatly compromised by what we term the ‘7 sins of bad debt’. Understanding these pitfalls is crucial to navigate through tough economic times effectively.

1. Excessive Credit Card Use: Over-reliance on credit cards for daily expenses can quickly snowball into unmanageable debt. High interest rates on unpaid balances can lead to a vicious cycle of borrowing. To avoid this, consumers should prioritize paying off high-interest debt and use credit cards judiciously.

2. Payday Loans: Payday loans may seem like a quick fix, but the exorbitant interest rates and fees can trap borrowers in a cycle of debt. These short-term loans often lead to more financial strain. Instead, consider alternatives such as personal loans from a bank or credit union.

3. Neglecting to Build an Emergency Fund: Without an emergency fund, any unexpected expense can force individuals to rely on credit. Ideally, an emergency fund should cover three to six months of living expenses. Start small and gradually build up the fund to provide a financial cushion.

4. Failing to Budget: Without a proper budget, it’s easy to lose track of spending and accumulate debt. A well-planned budget helps in monitoring expenses and directing funds towards savings and debt repayment. Utilize budgeting apps or seek financial counseling if necessary.

5. Living Beyond One’s Means: Lifestyle inflation can lead to debt when spending exceeds income. It’s essential to distinguish between needs and wants, and make conscious decisions to live within one’s means. Opt for cost-effective alternatives and avoid the temptation of luxury spending.

6. Ignoring Debt: Procrastinating on debt repayment only worsens the situation. Ignoring debt can lead to higher interest rates, penalties, and a damaged credit score. It’s important to address debt issues promptly and seek help if needed, such as through debt management plans or credit counseling.

7. Making Only Minimum Payments: Paying only the minimum amount due on credit cards and loans prolongs debt and increases the total interest paid. Aim to pay more than the minimum to reduce the principal balance faster and save on interest.

By recognizing and avoiding these ‘sins’ of bad debt, consumers can better manage their finances and mitigate the risks associated with economic downturns.

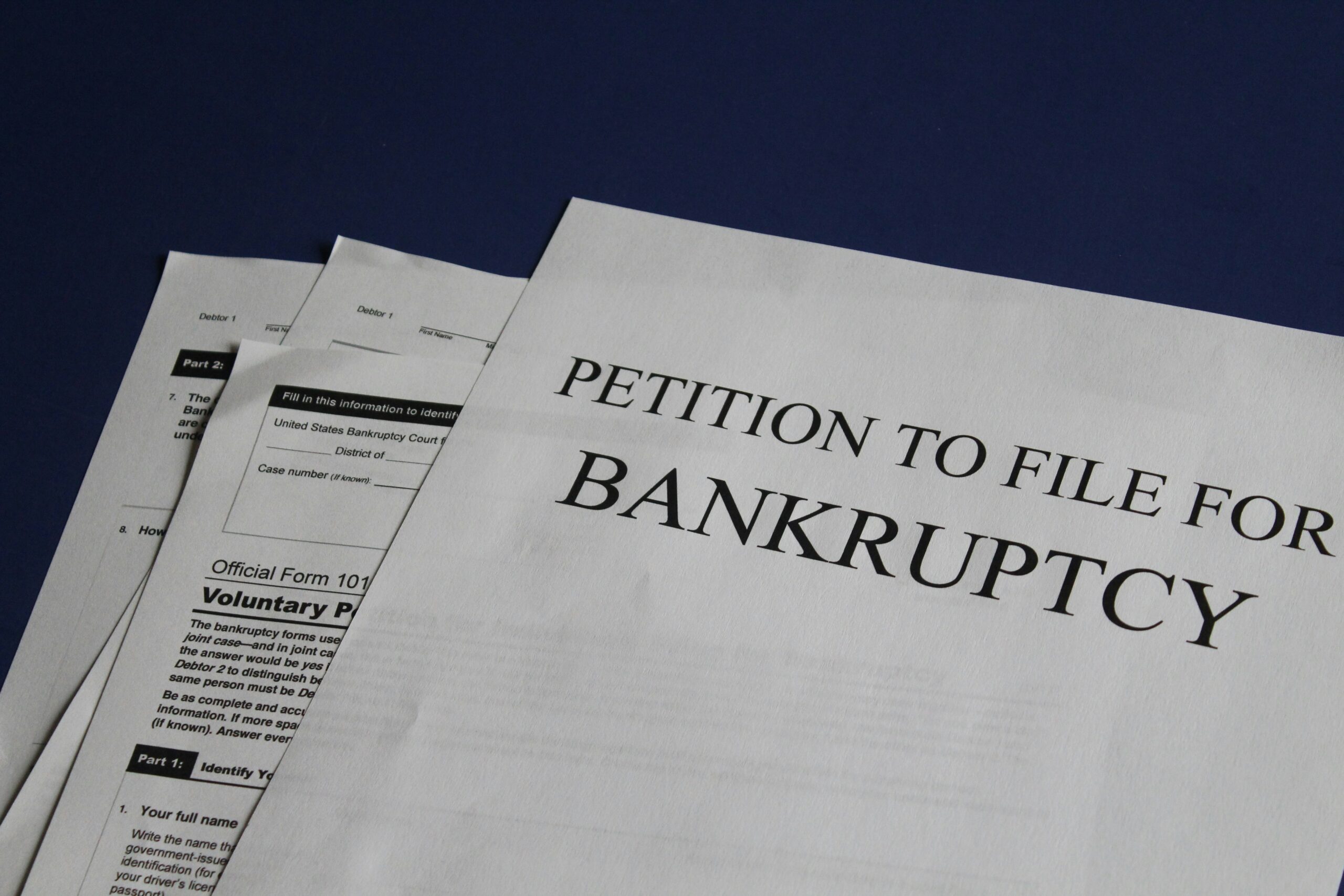

The Role of Consumer Chapter 7 Bankruptcy

Consumer Chapter 7 Bankruptcy, often referred to as “liquidation bankruptcy,” serves as a vital legal remedy for individuals burdened with insurmountable debt. This form of bankruptcy allows consumers to discharge most of their unsecured debts, offering a fresh financial start. To initiate the process, the debtor must first pass a “means test,” which evaluates their income, expenses, and overall financial situation. This test is designed to ensure that only those who genuinely cannot repay their debts are eligible for Chapter 7 relief.

Filing for Chapter 7 bankruptcy involves several key steps. Initially, the debtor must complete mandatory credit counseling from an approved agency. Following this, a detailed petition is filed with the bankruptcy court, including comprehensive financial disclosures. Once the court accepts the petition, an automatic stay goes into effect, halting most collection actions against the debtor. A court-appointed trustee then oversees the liquidation of the debtor’s non-exempt assets to repay creditors.

Not all debts are dischargeable under Chapter 7 bankruptcy. Commonly discharged debts include credit card debt, medical bills, and personal loans. However, certain obligations like student loans, child support, and most tax debts are typically non-dischargeable. Understanding which debts can be discharged is crucial for individuals considering this form of bankruptcy.

The intricacies of Chapter 7 bankruptcy necessitate the expertise of a qualified attorney. An experienced bankruptcy attorney can provide invaluable guidance throughout the process, from determining eligibility to ensuring accurate completion of required documentation. Legal counsel helps navigate potential pitfalls, such as asset exemptions and creditor objections, ultimately facilitating a smoother path to debt relief.

In essence, Consumer Chapter 7 Bankruptcy offers a structured and legally protected route for individuals to address overwhelming debt. Through careful evaluation and professional legal assistance, consumers can achieve a fresh start and regain financial stability, even amidst economic downturns.

Navigating Financial Recovery Post-Bankruptcy

Emerging from Chapter 7 bankruptcy can feel like a daunting challenge, but with deliberate steps and informed choices, financial recovery is achievable. A critical first step is reestablishing credit. Consumers should consider obtaining a secured credit card or a small loan with manageable terms. Regular, timely payments on these accounts will gradually help rebuild a positive credit history. It’s vital to monitor credit reports regularly to track progress and ensure accuracy.

Creating and adhering to a budget is equally essential. Post-bankruptcy, it is imperative to understand one’s financial limits and prioritize expenses. A realistic budget helps in managing income and outflows, ensuring that essential bills are paid first. Consumers could benefit from using budgeting tools or apps that offer detailed insights into spending patterns, helping to avoid unnecessary debt accumulation.

Building an emergency fund is another crucial step. Financial emergencies can arise unexpectedly, and having a reserve can prevent the need for high-interest loans or credit card debt. Consumers should aim to save a portion of their income regularly, no matter how small, to gradually build a cushion that can cover at least three to six months of living expenses.

Seeking financial education and counseling can provide invaluable guidance. Many organizations offer free or low-cost financial literacy programs that cover budgeting, saving, and investing. Additionally, credit counseling agencies can offer personalized advice and support, helping consumers to stay on track with their financial goals.

The emotional and psychological toll of bankruptcy should not be underestimated. It’s important for individuals to stay positive and motivated throughout their recovery journey. Surrounding oneself with supportive friends and family, as well as seeking professional counseling if needed, can aid in overcoming the stigma and stress associated with bankruptcy.

Inspiration can often be found in the success stories of others who have navigated similar challenges. Hearing how others have rebuilt their lives post-bankruptcy can provide hope and practical strategies. Expert advice from financial advisors and counselors can also guide consumers towards sustainable financial stability.

Ultimately, while the road to recovery post-bankruptcy may be steep, it is navigable with the right tools, mindset, and support systems. Financial stability and a brighter economic future are within reach for those who take proactive steps and remain committed to their recovery plan.