Understanding the Financial Strain on Families

When parents grapple with unmanageable business debt, the repercussions extend far beyond the confines of their enterprise. The financial strain on families in such scenarios can be profound, affecting both the immediate household budget and the long-term financial stability of the family unit. Managing business debt while ensuring household expenses are met—such as mortgage payments, utility bills, groceries, and childcare—becomes an overwhelming challenge. This dual burden can deplete family savings, limit access to credit, and create a precarious financial situation.

The emotional toll of this financial strain cannot be understated. Parents experiencing significant business debt often face heightened stress and anxiety, which can affect their mental health and overall well-being. The constant worry about financial security and the pressure to meet both business and family obligations can lead to burnout, strained relationships, and reduced productivity. These emotional burdens are not isolated to the parents; children, too, can feel the effects through increased household tension and potential changes in lifestyle.

For children, the consequences of their parents’ financial instability can be significant. Financial stress can lead to reduced investments in children’s education, extracurricular activities, and overall quality of life. In severe cases, families may face difficult decisions such as relocating to more affordable housing or foregoing essential needs. These adjustments can disrupt children’s routines and sense of security, impacting their emotional and psychological well-being.

Addressing these issues proactively is crucial to mitigating long-term financial instability. Seeking professional advice, such as consulting with financial advisors or bankruptcy attorneys, can help parents navigate their business debts more effectively. Moreover, exploring solutions like restructuring business operations or considering bankruptcy for families can provide a strategic pathway to regain financial stability. By taking decisive actions early, families can better safeguard their financial future and maintain a stable environment for their children.

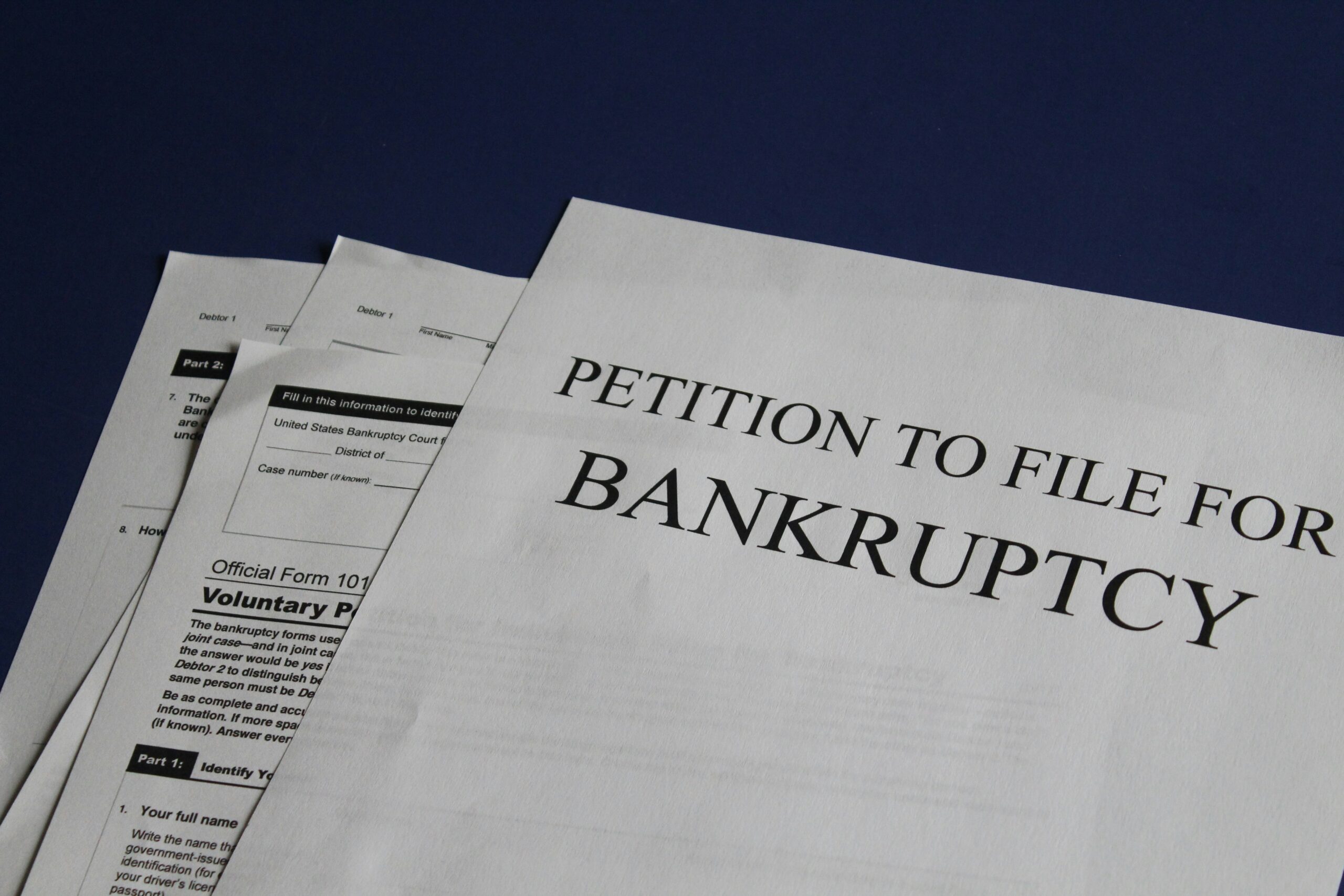

Evaluating Bankruptcy as a Viable Option

For parents grappling with unmanageable business debt, bankruptcy can serve as a strategic solution to regain financial stability. Understanding the different types of bankruptcy is crucial for making an informed decision. Primarily, there are three types of bankruptcy filings that individuals might consider: Chapter 7, Chapter 11, and Chapter 13.

Chapter 7 bankruptcy, often referred to as “liquidation bankruptcy,” involves the sale of a debtor’s non-exempt assets to pay off creditors. This type is suitable for families whose businesses have more liabilities than assets and minimal prospects for recovery. It allows for a relatively swift resolution, discharging most debts and providing a clear path to starting anew.

Chapter 11 bankruptcy, known as “reorganization bankruptcy,” is generally more complex and is used primarily by businesses with the intent of restructuring their debts while continuing operations. For families who believe their business has the potential to return to profitability, Chapter 11 offers a structured environment to renegotiate terms with creditors, thereby retaining control of the business while devising a feasible repayment plan.

Chapter 13 bankruptcy, or “wage earner’s plan,” is designed for individuals with a regular income. This type involves creating a repayment plan to pay back debts over a period of three to five years. It’s particularly useful for parents who have a steady income stream and wish to protect their family home from foreclosure, allowing them to manage debts without liquidating assets.

One of the common myths surrounding bankruptcy is that it signifies financial failure and will irreparably damage one’s credit. However, for many families, bankruptcy offers a strategic advantage by halting collection actions and providing a legal framework to manage overwhelming debt. It can be a lifeline, granting the opportunity for a financial reset and a fresh start.

In evaluating bankruptcy as an option, it is essential to consider the specific circumstances of the family and the business. Consulting with a bankruptcy attorney can provide valuable insights and help determine the most suitable type of bankruptcy, ensuring that parents make decisions that best support their long-term financial health.

Navigating the Bankruptcy Process

For parents grappling with unmanageable business debt, understanding the bankruptcy process is crucial. The journey begins with consulting a qualified bankruptcy attorney. This professional will evaluate your financial situation, explain the types of bankruptcy available—such as Chapter 7 and Chapter 13—and help you determine the most suitable option. An initial consultation will provide clarity on whether bankruptcy is a viable solution for your family.

Once you decide to proceed, gathering all necessary financial documents is the next step. This includes income statements, tax returns, lists of debts and assets, and any relevant business financial records. These documents are essential for your attorney to accurately assess your situation and prepare the required bankruptcy filings.

Understanding eligibility requirements is also a key part of the process. Different types of bankruptcy have specific criteria; for instance, Chapter 7 has a means test to determine if your income qualifies you for this type of bankruptcy. Your attorney will guide you through these requirements and help you understand what is expected.

During the bankruptcy proceedings, parents can expect several key events. Court appearances are mandatory, where you will formally file your case and respond to any questions from the judge. Another critical component is the meeting of creditors, also known as a 341 meeting. During this meeting, creditors have the opportunity to ask questions about your financial situation and the proposed bankruptcy plan. A bankruptcy trustee, appointed to oversee your case, plays a significant role in ensuring all procedures are followed and that the creditors’ interests are considered.

Managing family life during this period requires practical strategies to minimize stress. Open communication with your partner and children about the situation can foster a supportive environment. Additionally, maintaining a routine and seeking support from friends, family, or professional counselors can help ease the emotional burden. By staying organized and proactive, parents can navigate the bankruptcy process while mitigating its impact on family life.

Emerging from bankruptcy can be a daunting yet transformative journey for families grappling with overwhelming business debt. The first step towards rebuilding financial stability is re-establishing credit. Parents should obtain a secured credit card or a credit-builder loan to demonstrate responsible credit use. It’s essential to make timely payments and keep balances low, as these habits will gradually improve credit scores.

Effective budgeting plays a crucial role in the post-bankruptcy phase. Families must create a detailed budget that outlines all income sources and expenses. Prioritizing necessities such as housing, utilities, and groceries ensures that essential needs are met while avoiding further debt accumulation. Allocating a portion of income towards savings is also vital, providing a financial cushion for unexpected expenses and future goals.

Setting long-term financial goals helps families maintain focus and direction. These goals might include saving for children’s education, purchasing a home, or building a retirement fund. Breaking down these objectives into manageable steps and tracking progress can make them more attainable. Engaging the entire family in this process fosters a sense of teamwork and shared responsibility.

Communicating with children about financial changes is equally important. Honest discussions can help children understand the situation and reduce any anxiety they may feel. Parents should explain the reasons behind the budget adjustments and involve children in simple financial decisions, such as choosing cost-effective activities or planning family meals. This involvement not only educates children about financial management but also strengthens family bonds.

Success stories provide valuable inspiration and practical insights. For example, one family overcame bankruptcy by starting a small home-based business, gradually rebuilding their credit and financial stability. By setting realistic goals, maintaining open communication, and practicing disciplined budgeting, they were able to secure a brighter future. Such stories highlight the possibility of recovery and growth, offering hope to families navigating similar challenges.

Ultimately, bankruptcy for families dealing with unmanageable business debt can serve as a strategic reset. By focusing on credit re-establishment, effective budgeting, and long-term financial planning, families can move forward confidently, ensuring a secure and prosperous future.